Blacklist Loans: Top Loan Solutions For Those With Bad Credit

Are you struggling with bad credit and feeling like your financial options are limited? Don’t worry – blacklist loans offer a lifeline to those with less-than-perfect credit scores. These loan solutions are designed to provide fast access to funds, with low eligibility requirements and flexible repayment terms. Whether you need emergency cash or want to rebuild your credit, blacklist loans have competitive rates and a variety of options to fit your needs. Learn about the best loan solutions that can help you get back on track even with bad credit.

Blacklist Loans: A Lifeline for Those with Bad Credit

Are you struggling with a less-than-stellar credit score? Blacklist loans might be the financial solution you’ve been searching for. These specialized loan options are designed to help individuals who have been turned away by traditional lenders due to poor credit history. In this article, we’ll explore the world of blacklist loans, their advantages, and how they can help you get back on track financially.

Understanding Blacklist Loans

Blacklist loans, also known as bad credit loans, are financial products tailored for individuals with poor credit scores or those listed on credit blacklists. These loans provide an opportunity for borrowers to access funds when traditional banks and financial institutions may have rejected their applications. Blacklist loans typically come with higher interest rates to offset the increased risk for lenders, but they offer a crucial lifeline for those in need of financial assistance.

Advantages of Blacklist Loans

One of the primary benefits of blacklist loans is their accessibility. Unlike conventional loans, which often require a good credit score, blacklist loans are more lenient in their eligibility criteria. This means that even if you have a history of missed payments or defaults, you may still qualify for a blacklist loan. Additionally, these loans can help you rebuild your credit score over time by providing an opportunity to demonstrate responsible borrowing and repayment habits.

Types of Blacklist Loans Available

There are several types of blacklist loans to choose from, depending on your specific needs and circumstances. Payday loans are short-term, high-interest loans designed to tide you over until your next paycheck. Installment loans allow you to borrow a larger sum and repay it over a set period in fixed monthly installments. Secured loans require collateral, such as a car or property, which can help you access lower interest rates. Unsecured loans, while riskier for lenders, don’t require collateral but may come with higher interest rates.

Top Lenders Offering Blacklist Loans

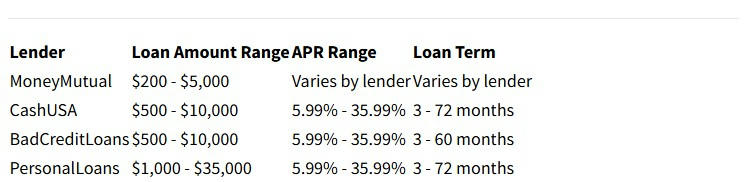

When seeking a blacklist loan, it’s essential to research and compare different lenders to find the best option for your situation. Some reputable lenders specializing in blacklist loans include MoneyMutual, CashUSA, and BadCreditLoans. These platforms connect borrowers with a network of lenders willing to work with individuals with less-than-perfect credit. Remember to carefully review the terms and conditions of any loan offer before accepting.

Interesting Facts About Blacklist Loans

•Blacklist loans can range from small amounts of a few hundred dollars to larger sums of several thousand dollars, depending on the lender and your financial situation.

•Some blacklist loan providers offer financial education resources to help borrowers improve their credit scores and overall financial health.

•The application process for blacklist loans is often quick and straightforward, with many lenders providing online applications and fast approval times.

•While blacklist loans can be helpful in emergencies, they should be used responsibly and not as a long-term financial solution.

•Some employers may offer salary advance programs as an alternative to blacklist loans, which can be a more affordable option for those facing short-term financial difficulties.

How to Apply for a Blacklist Loan

Applying for a blacklist loan is typically a straightforward process. Start by researching different lenders and comparing their terms, interest rates, and eligibility requirements. Once you’ve chosen a lender, gather the necessary documentation, such as proof of income, bank statements, and identification. Many lenders offer online applications, which can be completed in minutes. After submitting your application, the lender will review your information and provide a decision, often within 24 hours. If approved, you’ll receive the loan terms and conditions for review before accepting the offer.

Note: The information provided in this table is based on current research and may vary. Interest rates and loan terms are subject to change and may depend on individual circumstances. It is recommended to conduct independent research and compare offers from multiple lenders before making a decision.

While blacklist loans can provide a valuable financial lifeline, it’s crucial to approach them with caution. Always borrow responsibly, ensuring you can meet the repayment terms. If possible, explore alternative options such as credit counseling or debt consolidation before taking on a high-interest loan. By using blacklist loans wisely and working to improve your credit score, you can gradually rebuild your financial health and access better borrowing options in the future.

The shared information of this article is up-to-date as of the publishing date. For more up-to-date information, please conduct own research.